CAPM: the Capital Asset Pricing Model 资本资产定价模型

符号定义

市场组合: \(R_m, \sigma_{R_{m}}\)

某风险资产: risky asset: \(R, \sigma_R\)

由这两种资产构建的一个新的组合,下标 \(\alpha\):

\[R_\alpha = \alpha \cdot R + (1-\alpha) \cdot R_m\]

\[E[R_\alpha] = \alpha \cdot \bar{R} + (1-\alpha) \cdot \bar{R}_m\]

\[\sigma^2_{R_{\alpha}} = \alpha^2 \sigma_R^2 + (1-\alpha)^2 \sigma_{R_m}^2 + 2\alpha(1-\alpha)\sigma_{R, R_m}\]

推导

首先需要强调,CAPM 假设全体投资者都了解市场组合的存在并持有,

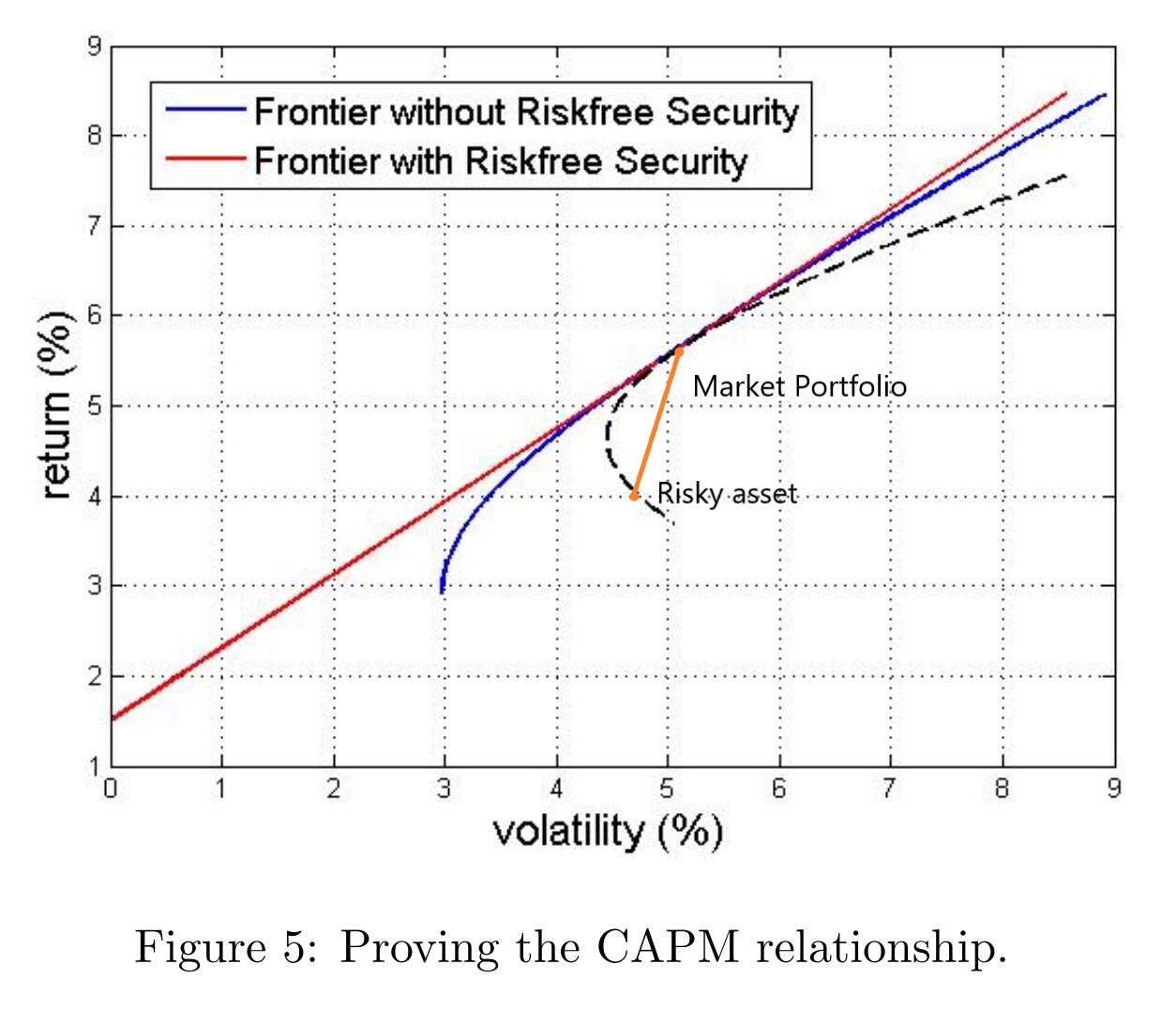

定性的给出 \((\sigma_{R_\alpha}, E[R_\alpha])\) 的曲线:

随着 \(\alpha\) 变化,形成图中的虚线。

该曲线不能超过有效前沿曲线,因为这里选取的风险资产本身是有效前沿内部的一个点,市场组合是有效前沿上的点,两者的组合自然在有效前沿内部。

在推导有效前沿形状时,曾考虑一个最简单的两资产模型: - 如果这两个资产完全正相关,构成的组合在两点连成的线段上; - 完全负相关,则有效前沿形成一个 V 字形,最终在 y 轴上形成一个零风险但高于无风险利率的回报率; - 否则弯成一个二次曲线。

当 \(\alpha = 0\) 时该曲线应与 CML 切于市场组合点。根据该性质,推导该新组合和市场组合的关系。

\[\frac{\partial E[R_\alpha]}{\partial \sigma_{R_\alpha}} \bigg |_{\alpha = 0} = \left (\frac{dE[R_\alpha]}{d\alpha} \bigg / \frac{d\sigma_{R_\alpha}}{d\alpha} \right) \bigg|_{\alpha = 0}\]

分别求解分子分母,

\[\frac{dE[R_\alpha]}{d\alpha} = \bar{R} - \bar{R}_m\]

\[\frac{d\sigma_{R_\alpha}}{d\alpha} = \frac{d\sigma^2_{R_\alpha}}{d\alpha} \bigg/ 2\sigma_{R_\alpha} \]

\[\because \frac{d\sigma^2_{R_\alpha}}{d\alpha} = 2 \sigma_R^2 \alpha + \sigma_{R_m}^2(2\alpha-2) + 2\sigma_{R, R_m}\]

\[\therefore \frac{d\sigma_{R_\alpha}}{d\alpha} = \frac{2 \sigma_R^2 \alpha + \sigma_{R_m}^2(2\alpha-2) + 2\sigma_{R, R_m}} {2\sigma_{R_\alpha}}\]

当 \(\alpha = 0\),新的组合就是原来的市场组合,\(R_\alpha \equiv R_m\)

\[\begin{aligned} \therefore \frac{d\sigma_{R_\alpha}}{d\alpha} \bigg|_{\alpha = 0} &= \frac{2 \sigma_R^2 \alpha + \sigma_{R_m}^2(2\alpha-2) + 2\sigma_{R, R_m}} {2\sigma_{R_\alpha}} \bigg|_{\alpha = 0} \\ &= \frac{-\sigma_{R_m}^2 + \sigma_{R, R_m}} {\sigma_{R_m}} \end{aligned}\]

综上,

\[\frac{\partial E[R_\alpha]}{\partial \sigma_{R_\alpha}} \bigg |_{\alpha = 0} = \frac{(\bar{R} - \bar{R}_m)\sigma_{R_m}}{-\sigma_{R_m}^2 + \sigma_{R, R_m}}\]

同时,资本市场线 CML 的斜率已知,

\[\frac{\bar{R}_m - r_f}{\sigma_{R_m}}\]

新组合曲线在市场组合这一点的斜率和 CML 相等,

\[\therefore \frac{(\bar{R} - \bar{R}_m)\sigma_{R_m}}{-\sigma_{R_m}^2 + \sigma_{R, R_m}} = \frac{\bar{R}_m - r_f}{\sigma_{R_m}}\]

\[\bar{R} - \bar{R}_m = \frac{-\sigma_{R_m}^2 + \sigma_{R, R_m}}{\sigma_{R_m}^2}(\bar{R}_m - r_f)\]

\[\bar{R} - r_f = \frac{\sigma_{R, R_m}}{\sigma_{R_m}^2}(\bar{R}_m - r_f) = \beta (\bar{R}_m - r_f) \]

其中 \(\beta = \frac{\sigma_{R, R_m}}{\sigma_{R_m}^2}\)。