1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

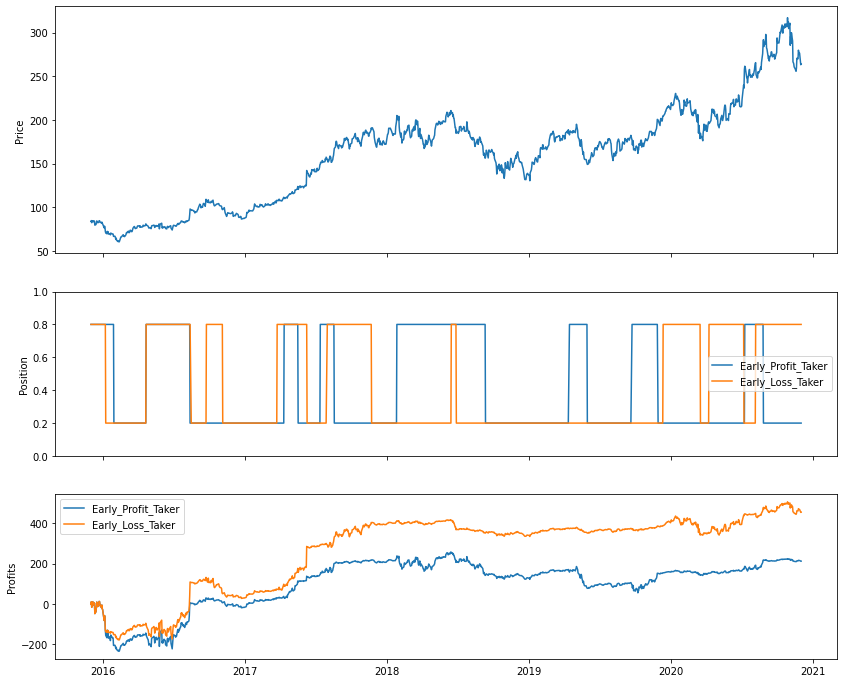

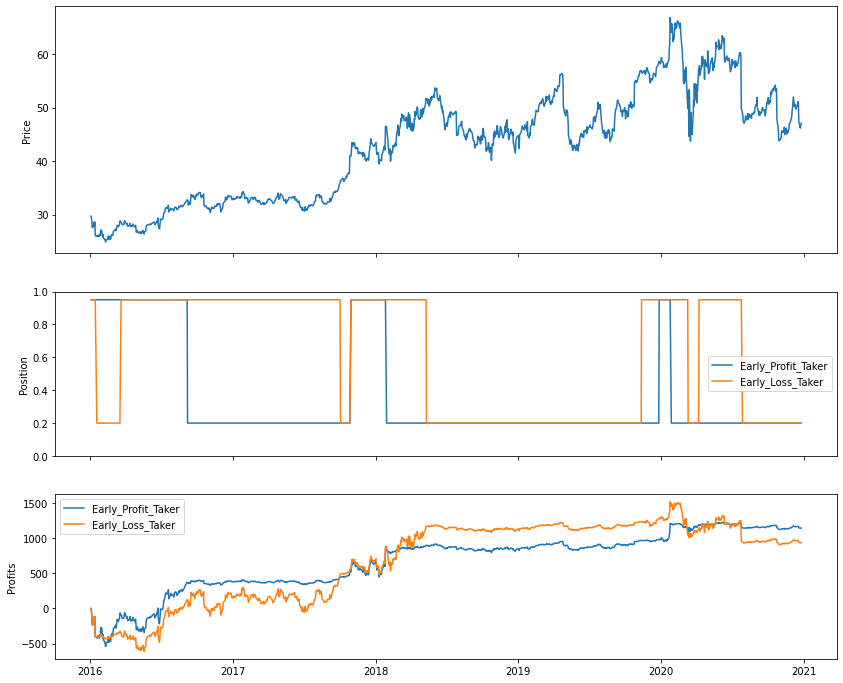

| def plot_strategy_comparison(

principal = 1e5,

tol_hi = 0.3,

tol_lo = 0.1,

position_hi = 1,

position_lo = 0.1,

data = BABA,

):

position, num_stocks, gain = strategy_modeling(

principal,

'Early_Profit_Taker',

tol_hi,

tol_lo,

position_hi,

position_lo,

data,

)

position_, num_stocks_, gain_ = strategy_modeling(

principal,

'Early_Loss_Taker',

tol_hi,

tol_lo,

position_hi,

position_lo,

data,

)

fig,ax = plt.subplots(3, 1, sharex=True, figsize=(14,12), gridspec_kw={'height_ratios': [3, 2, 2]})

ax[0].plot(data.index, data["Adj Close"])

ax[0].set_ylabel("Price")

ax[1].plot(data.index, position)

ax[1].plot(data.index, position_)

ax[1].set_ylim(0, 1)

ax[1].legend(["Early_Profit_Taker", "Early_Loss_Taker"])

ax[1].set_ylabel("Position")

ax[2].plot(data.index, gain)

ax[2].plot(data.index, gain_)

ax[2].legend(["Early_Profit_Taker", "Early_Loss_Taker"])

ax[2].set_ylabel("Profits")

plt.show()

|